The allure of cryptocurrency mining, particularly Bitcoin, stems from its decentralized nature and the potential for financial reward. But beneath the surface of digital gold lies a complex mechanism known as “mining difficulty,” a dynamic algorithm that significantly impacts profitability and necessitates a keen understanding for anyone venturing into this space.

Bitcoin mining, at its core, is the process of verifying and adding new transaction records to the blockchain, a public ledger that secures the cryptocurrency network. Miners use specialized hardware, often referred to as “mining rigs,” to solve complex cryptographic puzzles. The first miner to solve the puzzle gets to add the next block of transactions to the blockchain and is rewarded with newly minted Bitcoin, along with transaction fees.

However, as more miners join the network, the overall computing power, known as the “hash rate,” increases. To maintain a consistent block creation time (approximately every 10 minutes for Bitcoin), the mining difficulty automatically adjusts. This adjustment ensures that the average time it takes to find a new block remains relatively constant, regardless of the number of miners competing.

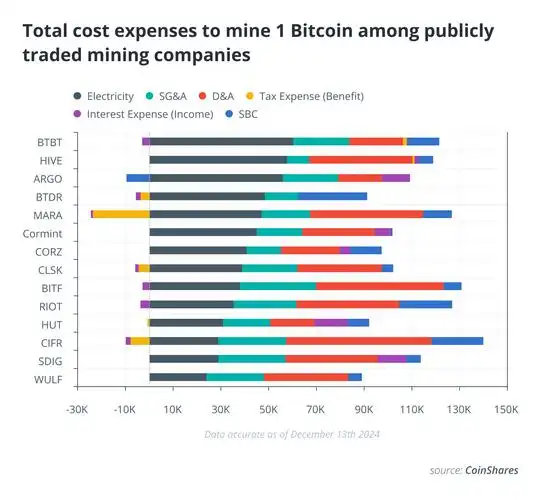

The implications of mining difficulty are profound. As difficulty increases, miners require more computational power and therefore more electricity to have a chance of solving the puzzle and earning rewards. This directly affects profitability. If the cost of electricity and hardware exceeds the value of the Bitcoin mined, the mining operation becomes unprofitable.

This is where strategic decisions come into play. Miners must carefully consider factors such as electricity costs, hardware efficiency (measured in hash rate per watt), and the current Bitcoin price. Furthermore, the choice of mining pool, a collaborative effort where miners pool their resources and share rewards, can also influence profitability.

Beyond Bitcoin, other cryptocurrencies like Dogecoin (DOGE) and Ethereum (ETH) also employ mining mechanisms, though often with different algorithms and varying degrees of difficulty. Dogecoin, initially designed as a meme coin, utilizes a Scrypt-based algorithm, which is generally less energy-intensive than Bitcoin’s SHA-256. Ethereum, before its transition to Proof-of-Stake (PoS), used a different algorithm known as Ethash. The evolution of Ethereum highlights the adaptability and ongoing development within the cryptocurrency space, impacting the future needs and viability of specific mining hardware.

The fluctuating difficulty also impacts the decision of whether to invest in dedicated mining hardware or opt for mining machine hosting. Hosting services offer miners the opportunity to house their equipment in specialized data centers, often located in regions with lower electricity costs. These facilities typically provide cooling, maintenance, and stable internet connectivity, alleviating the burden of managing the infrastructure themselves. However, hosting fees eat into potential profits, so careful evaluation is crucial. Moreover, individuals may choose cloud mining services, which is essentially renting hashing power without owning the physical mining machines.

The exchange rate fluctuations for Bitcoin and other cryptocurrencies also have a significant influence. A sudden drop in the price of Bitcoin, coupled with increasing mining difficulty, can swiftly render even the most efficient mining operations unprofitable. Conversely, a surge in price can boost profitability, incentivizing more miners to join the network and ultimately increasing the difficulty.

Beyond the technical aspects, ethical considerations also come into play. The energy consumption associated with cryptocurrency mining has raised environmental concerns, particularly in regions relying on fossil fuels for electricity generation. Sustainable mining practices, such as utilizing renewable energy sources, are becoming increasingly important to mitigate the environmental impact and promote a more responsible industry.

Navigating the complexities of Bitcoin mining difficulty requires a multi-faceted approach, encompassing technical understanding, financial acumen, and a commitment to sustainable practices. It’s a dynamic landscape where constant adaptation and informed decision-making are paramount to achieving profitability in the long run.

Mining farms represent a concentrated effort to capitalize on economies of scale. These facilities house vast arrays of mining rigs, often leveraging advanced cooling technologies and direct access to power grids. The efficiency gains realized in mining farms can help offset higher difficulty levels. But the initial investment to establish and maintain these facilities can be prohibitive for smaller operators.

In conclusion, understanding Bitcoin mining difficulty is crucial for navigating the profit challenges inherent in this complex ecosystem. It’s not simply about deploying powerful hardware. It’s a continuous assessment of costs, market conditions, and technological advancements to stay ahead in the digital gold rush. The future of cryptocurrency mining will likely involve greater specialization, energy efficiency, and integration of renewable energy sources to ensure its sustainability and long-term viability.

This article delves into Bitcoin mining difficulty, exploring its impact on profitability, technological advancements, and energy consumption. It offers insights into market dynamics, strategic mining approaches, and future trends, providing a comprehensive guide for both novices and experienced miners navigating evolving challenges.