The landscape of cryptocurrency mining is on the cusp of a new era, brimming with potential as we approach 2025. With the rising prominence of digital currencies like Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG), the focus is not only on mining machines but also on the evolving practices of hosting those machines. This evolution is redefining investment strategies for both seasoned miners and newcomers looking to capitalize on the growing demand for cryptocurrencies.

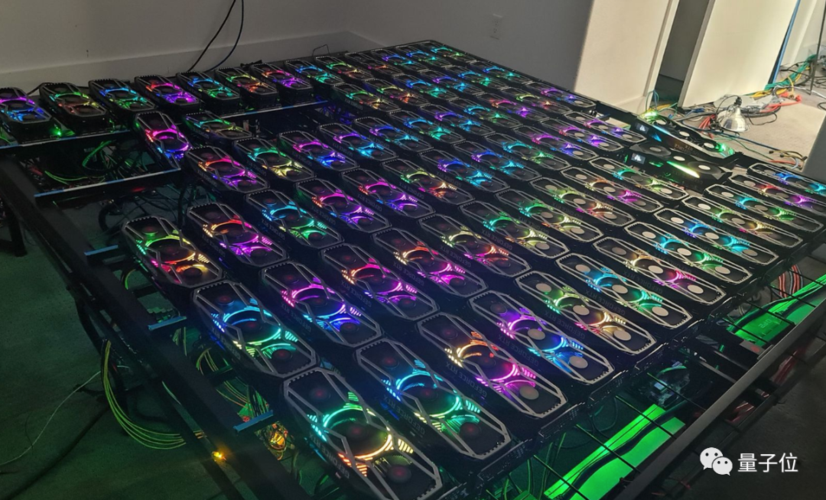

As we delve deeper into the intricacies of this industry, one cannot ignore the pivotal role played by efficient mining rigs. A high-performance mining rig can significantly influence profitability by optimizing hash rates and minimizing energy consumption. By 2025, it is anticipated that there will be a surge in the demand for more efficient models, as miners experience increasing pressure from fluctuating cryptocurrency prices and rising operational costs.

Despite the technical specifications, it’s the relationship between mining and hosting that merits exploration. Hosting services have been gaining traction, allowing miners to offload significant operational challenges while still retaining a stake in the crypto space. Hosting centers provide controlled environments, professional maintenance, and reliable electricity, which are vital for maximizing mining efficiency. As more investors recognize this opportunity, expect to see increased investment flowing into these facilities in the next few years.

The interplay between cryptocurrency exchanges and mining investment is equally intriguing. Exchanges are becoming essential platforms not only for trading but also for acquiring cryptocurrencies directly from mined sources. With Bitcoin leading the charge, Ethereum’s transition to proof-of-stake is presenting unique opportunities and challenges for miners. How will those still engaged in mining ETH adapt their strategies? Diversifying investments into altcoins or increasing rigs specifically targeted at niche cryptocurrencies could become commonplace.

Investors should also prioritize educating themselves about the rapidly evolving regulatory landscape concerning cryptocurrency miners and exchanges. As governments worldwide become more involved, understanding the implications of these regulations can offer an edge in making informed investment decisions. Different regions may have varying policies, affecting hosting services and equipment reliability, hence shaping investment outcomes.

Moreover, technological advancements within mining rigs and hosting facilities will continue driving the industry forward. Innovations like liquid cooling systems, ASIC miner enhancements, and renewable energy solutions are reshaping the energy consumption narrative surrounding cryptocurrency mining. This shift towards greener practices is likely to attract a demographic of health-conscious investors keen on sustainability.

The future of cryptocurrency mining investment is not merely about numbers; it’s about narratives. Each cryptocurrency, from the staple BTC to the ‘meme-inspired’ DOGE, carries its unique story and market dynamics that investors must consider. With each currency comes varying degrees of volatility and opportunity. As we approach 2025, storytelling around these investments will influence how the market evolves. Investors who can articulate a compelling narrative about their chosen cryptocurrency are likely to resonate more with potential stakeholders.

Finally, as the numbers and trends play out, community engagement cannot be overlooked. The strength of a mining community lies in shared knowledge and collaboration. Online forums, social media groups, and meet-ups allow miners to exchange ideas, strategies, and support. The connectivity of the cryptocurrency community contributes immensely to its resilience and capacity for growth. Learning from each other’s experiences is invaluable as we navigate these tumultuous waters.

In conclusion, the future of cryptocurrency mining investment in 2025 paints an exhilarating picture filled with challenges and opportunities. As technological advancements, regulatory changes, and market dynamics shape the landscape, the potential for significant returns on investment is ever-present. Investors willing to adapt and diversify while engaging with the cryptocurrency community are likely to emerge as the front-runners in this promising domain.

Mining’s 2025? Forget ASICs, think green grids and quantum exploits. Regulation tightens, retail fades. AI mining managers and sustainable solutions dominate, or complete collapse.